Activities

The Background and Activities of Building the Iraqi Microfinance Industry

The Iraqi microfinance industry, including institutional (MFI) partners and the USAID-Tijara Sustainable Microfinance Component (SMFC), are increasing and improving the quality of the access to inclusive, quality financial services. Such services are crucial to making the Iraqi financial sector inclusive even to the poorest of people by offering and providing quality financial services on a sustainable basis. Training and technical assistance to MFIs will continue. The industry will progress in dialogue with the Central Bank of Iraq (CBI) and other Iraqi authorities to support transforming MFIs. The industry will also continue dialogue with funders, current and potential, to adhere to and respect microfinance best practice standards.

Iraq historically has an active informal finance sector that has operated for centuries. These mostly include family- or village-based rotating savings and credit societies. Microfinance based on international best-practice standards only began in 2003. It started as a supply-driven initiative promoted by Provincial Reconstruction Teams. This approach well served short-term military stabilization needs and the surge through 2007. Iraqis quickly got employed or started gainful businesses. The opportunity and potential of microfinance to become institutionalized and mainstreamed into the financial sector on a long-term basis was not as well recognized then as it is in 2010.

Growth in outreach to clients was as high as 78% per annum through December 2007. Into 2010, annual growth has stablized at 39%. While dynamic, the industry continues to face problems including, among others, lack of capital and institutional capacity to meet the significant demand for quality financial services. It is estimated that the industry only serves at most 6% of the potential demand in terms of clientele and their families1. The industry also is not well supported at the macro level in promoting an enabling environment that has a legal and regulatory framework that serves licensing and regulatory needs, credit bureau services, performance monitoring systems, etc. Poor public security in Iraq also continues to adversely affect the industry’s potential for greater growth.

Activities of the Iraqi Microfinance Industry in 2010 and Beyond

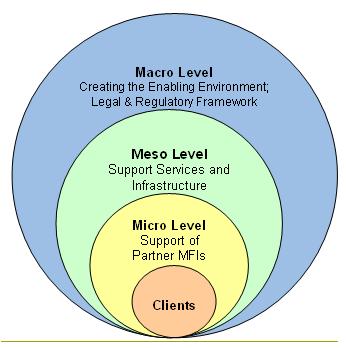

The support USAID-Tijara provides in partnership with its Iraqi MFI partners for the industry as a whole is comprehensive. It is provided in the context of a global approach for building inclusive financial systems, or microfinance: from the macro through the meso down to the micro levels.

The Approach Levels are:

Macro Level

Meso Level

Micro Level